Invest in a golden future

For centuries, single malt Scotch whisky has stood for class, quality and craftsmanship. For the past couple of years, we can add a new feature: a serious investment opportunity.

Elevate your assets with liquid gold

Three reasons to invest in single malt

Growth driven by rarity, time and demand

In a volatile financial landscape, rare whisky stands out as a robust asset. Driven by the passage of time, increasing global demand, and the inherent scarcity of aged spirits, the value of rare single malt is less affected by the turbulence of traditional stock markets. While the broad market shows solid growth, Scotch Whisky Investments' specialised portfolios have realized an average historical return of 10.6% per annum (2018–2025).

Strategic diversification

True stability comes from low correlation. Adding Scottish single malt to your portfolio offers a sophisticated way to mitigate risk, as whisky values often move independently of traditional financial markets. It combines the tangible security of physical ownership with proven long-term value development. It is not just an alternative investment, it is a strategic anchor for a well-balanced portfolio.

An Investment in heritage

Investing in single malt is about more than just numbers, it is about owning a piece of history. Each cask and bottle represents centuries of craft, the unique terroir of Scotland, and a level of rarity that cannot be replicated. At Scotch Whisky Investments, we turn this passion for heritage into a professional, managed investment experience.

Experience the value of whisky investments

Professional management, proven growth and absolute exclusivity

At Scotch Whisky Investments, whisky is more than a passion, it is a strategic asset with a proven track record of long-term growth. Our inventory consists exclusively of the rarest Scottish single malt whisky bottles, which are ultra-premium assets representing only 0.7% of the total market.

To maximise the potential of these assets, we provide a tailored approach for every investment, starting with professional Cask Management in our specialised warehouse in Glenrothes, Scotland. In this controlled environment, we meticulously monitor the maturation process to ensure each cask develops its unique character and reaches its maximum market value.

Complementing this, our rare bottles are kept in high-security, climate-controlled storage in both the Netherlands and Scotland to preserve their heritage and long-term investment potential.

From private tastings to high-end networking events, we connect deep market knowledge and exclusivity with a focus on sustainable returns. We invite you to discover the possibilities and experience the growing value of professional whisky investments.

Liquid gold

The genuine value of whisky

- 01 The value of a bottle

- 02 The value of a cask

- 03 The value of the region

- 04 The value of scarcity

- 05 The value of time

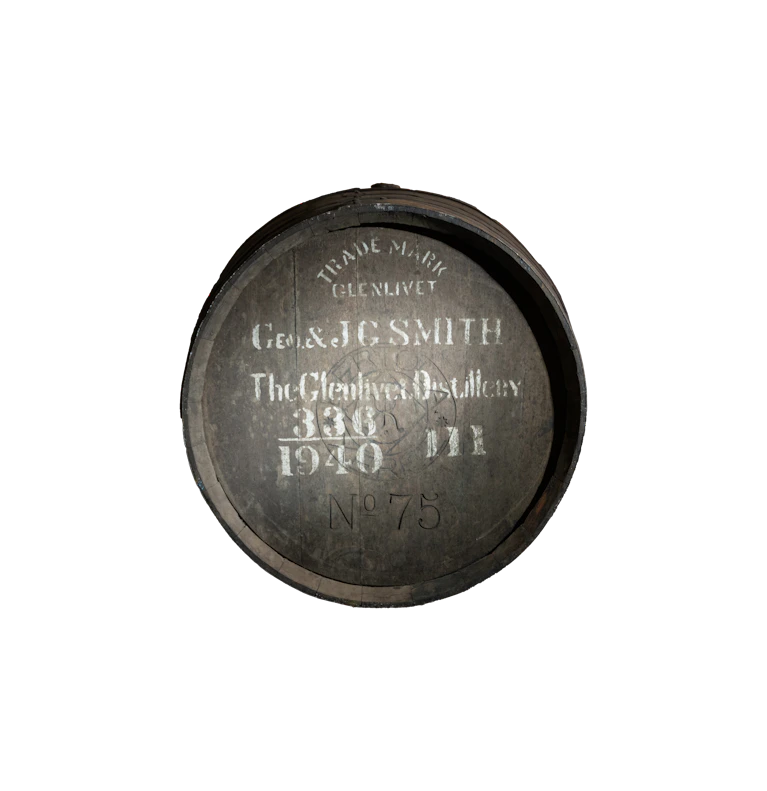

Gordon & MacPhail ARTISTRY IN OAK 1940

Distillery: Glenlivet

Bottler: Gordon & MacPhail

This 85-year-old whisky is the oldest single malt Scotch the world has ever seen, a historic monument bottled after more than eight decades of patience. The decanter was created in partnership with world-renowned architect Jeanne Gang and serves as a celebration of the profound artistry and care required to preserve such liquid heritage. Each decanter is a unique masterpiece that blurs the line between a high-end investment and museum-grade art.

Single cask number 336

Spirit from the Glenlivet Distillery was entrusted on 3 February 1940 to a specific, hand-selected American oak cask that had previously held mature sherry. Over 85 years, this cask has shaped the whisky into a robust and complex spirit, with the expertise of four generations of the Urquhart family ensuring the quality and strength remained remarkable at 43.7% ABV.

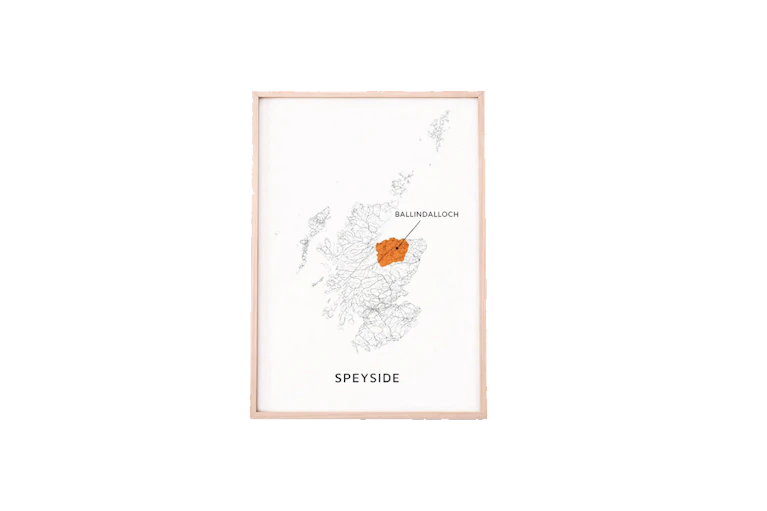

Region: Speyside

Place of origin: Ballindalloch

Speyside is the historic heartland of Scotch whisky production and home to the most refined single malts in the world. The Glenlivet Distillery was the pioneer that set the standard for this region, and this 85-year-old expression reflects the elegance and deep history of the Scottish terroir in its purest form.

Limited number of 125 decanters

This 85-year-old whisky is part of an exclusive range of exceptional quality, and it is exactly this exclusivity that holds a special appeal for collectors. Its immense prestige was recently proven when decanter #1 was auctioned by Christie’s New York, fetching a staggering $200,000. Every time one of these 125 decanters is opened, the rarity, and subsequently the value of your own bottle, increases.

Distillation date: 3 February 1940

Bottling date: 5 February 2025

Time is the most precious factor in the world of whisky investments, as a maturation of 85 years cannot be artificially accelerated or reproduced in any way. The interaction between wood and spirit over more than eight decades has resulted in an unparalleled depth of flavor and price, a value that only grows the longer the whisky remains sealed.

Q3 2025 update

The whisky market seems to regain its balance

The whisky market is currently in a phase of correction and reorientation. While the secondary market is showing signs of stabilization, the primary market remains under pressure with declining exports and reduced production. Interestingly, parallels are emerging with the 1980s, when scarcity laid the foundation for many of today’s most iconic bottlings. For investors, the key lies in selectivity and maintaining a long-term perspective. Scotch Whisky Investments analyzed the latest findings from the Noble & Co Whisky Intelligence Report (Q3 2025).

The results speak for themselves

Let time work in your favour

See what returns you could potentially earn.

Would you like to see some other interesting figures?

Investment optionsHow much would you like to invest?

By moving the slider, you will see the expected net return in 5 years next to the chosen investment amount. Interested in the anticipated results after 7 years? Feel free to make an appointment with our experts.

100K

5M

Starting amount€100.000

Indicative charts. Expected net return between 6% and 11%, depending on investment amount, risk profile, period and market developments.

Bespoke investments

Discover the options

We offer various entry-level options for an investment that meets your requirements.

THE SWEX

From €1,000

Full-featured investment platform.

100,000 unique bottles and bottles in cask.

Real-time pricing information on the platform’s current transactions.

Fully insured for any damages, lost or theft.

Asset Management

From €100,000

Term: indefinite period with a minimum of five years.

Management, storage, and insurance costs: included for the first five years.

Historical value development: average of 10.6% per year (2018–2025).

Investors Club

From €250,000

Term: indefinite period with a minimum of five years.

Management, storage, and insurance costs: included for the first five years.

Historical value development: average of 10.6% per year (2018–2025).

Unique investment opportunities.

Exclusive participation to events.

A reliable partner

Scotch Whisky Investments

Since 2007, we have been pioneers in whisky as an investment asset. Operating under the supervision of the Netherlands Authority for the Financial Markets (AFM), we manage over €320 million for more than 1,500 clients. Supported by years of expertise, a strong purchasing position with Scottish distilleries and a regulated operating model, we provide careful and care-free asset management for serious investors such as you.

Featured in

Speak to an expert

Curious about the possibilities?

Make an appointment with one of our consultants for a bespoke investment.

Contact